Irs vehicle depreciation calculator

Make the election under section 179 to expense certain property. The MACRS Depreciation Calculator uses the following basic formula.

How To Calculate Depreciation Expense For Business

Claim your deduction for depreciation and amortization.

. Depreciation limits on business vehicles. You can generally figure the amount of your deductible car expense by using one of two methods. D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the depreciation.

Use this depreciation calculator to forecast the value loss for a new or used car. So 11400 5 2280 annually. If you enter 100000 for basis and business use is 80 then the basis for depreciation adjusted basis is 80000.

Prime Cost Depreciation Method The Prime Cost method allocates the costs evenly over the years of ownership. Our Car Depreciation Calculatorbelow will allow you to see the expected resale value of over 300 modelsfor the next decade. Use Form 4562 to.

Depreciation limits on business vehicles. Provide information on the. The standard mileage rate method or the actual expense method.

The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you. Our Car Depreciation Calculatorbelow will allow you to see the expected resale value of over 300 modelsfor the next decade. The depreciation is calculated by applying the vehicles depreciation rate average high or low and.

Cost x Days held 365 x 100 Effective. If you use this method you need to figure depreciation for the vehicle. By entering a few details such as price vehicle age and usage and time of your ownership we use.

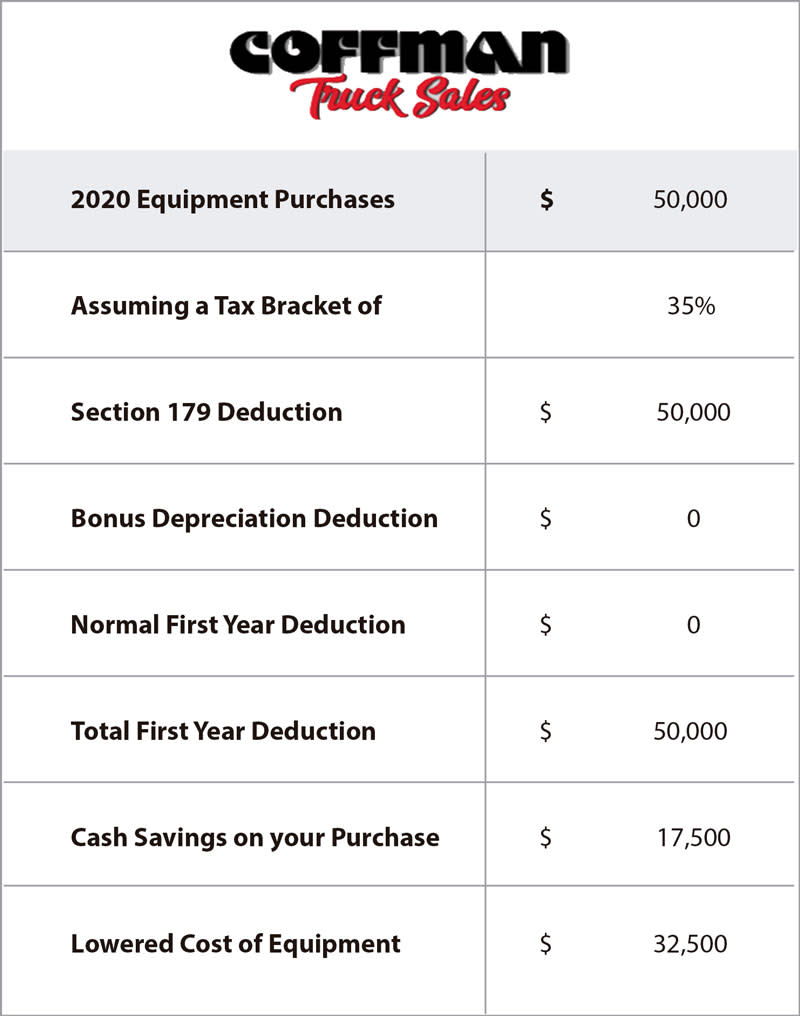

Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items. We will even custom tailor the results based upon just a few of. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and.

You can claim business use of an automobile on. Schedule C Form 1040 Profit or Loss From. 18100 First-Year Depreciation for Qualifying Models In 2021 and under IRC 168 k your business may have qualified for a federal income tax deduction up to 18100 of the purchase.

SLD is easy to calculate because it simply takes the depreciable basis and divides it evenly across the useful life. If you are using the. Simply enter in the purchase price of your equipment andor software and let the calculator take care of the rest.

The depreciation is calculated by applying the. A car that doesnt depreciate as much will save you more money than one that costs a little less to fill up and lasts longer between refuels. When its time to file your.

It takes the straight line declining balance or sum of the year digits method. Depreciation Calculator The following calculator is for depreciation calculation in accounting. Depreciation formula The Car Depreciation.

The calculator makes this calculation of course Asset Being Depreciated - This has no impact on the calculation. Heres an easy to use calculator that will help you estimate your tax savings. It is included here so that when you print a schedule it.

Determine how your vehicles value will change over the time you own it using this tool.

Macrs Depreciation Calculator With Formula Nerd Counter

Macrs Depreciation Calculator Based On Irs Publication 946

7 Fishbone Diagram Templates Pdf Doc Diagram Excel Templates Templates Printable Free

Section 179 Bonus Depreciation Saving W Business Tax Deductions Envision Capital Group

Free Macrs Depreciation Calculator For Excel

Section 179 Bonus Depreciation Saving W Business Tax Deductions Envision Capital Group

What Is An Account Holder Definition Overview 4 Facts In 2022 Accounting Business Bank Account Credit Card Account

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

1 Free Straight Line Depreciation Calculator Embroker

Irs Announces Luxury Auto Depreciation Caps And Lease Inclusion Amounts Doeren Mayhew Cpas

Section 179 Tax Deduction Coffman Truck Sales

Macrs Depreciation Calculator Irs Publication 946

Section 179 Deduction Hondru Ford Of Manheim

Accounting For Rental Property Spreadsheet Income Statement Statement Template Profit And Loss Statement

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

:max_bytes(150000):strip_icc()/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

Form 4562 Depreciation And Amortization Definition

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Business Tax Deductions Small Business Tax Deductions Tax Deductions